Before you leave...

Take 20% off your first order

10% off

Enter the code below at checkout to get 20% off your first order

Couldn't load pickup availability

Free standard shipping on orders over SAR-150

Readifyy.com delivers books to all cities across Saudi Arabia. Please note that certain titles or items may be restricted for delivery due to publisher or regional regulations.

When you place an order, we will provide an estimated shipping and delivery date based on the availability of your items and the shipping option you choose. Delivery timeframes depend on your location and the selected courier service. Estimated delivery dates may appear on the shipping quotes page during checkout.

We offer free delivery on all orders over 150 SAR. Standard shipping rates will apply for orders below this amount, as shown during checkout.

If your package is lost, arrives damaged, or is delayed, please contact Readifyy Customer Support within 7 days of the expected delivery date. We will investigate the issue and arrange a suitable resolution.

For any questions or assistance, feel free to contact us at readifyy01@gmail.com.

At Readifyy.com, we ensure every book is carefully packed and delivered in excellent condition. Returns or exchanges are accepted only if the item you received is damaged, incorrect, or contains three (3) or more blank pages that affect readability.

If you receive a damaged or wrong book, you can request an exchange within 48 hours of receiving your order. Please contact our customer support team and provide clear photos of the issue for verification.

Once your exchange request is approved, our team will guide you through the replacement process. Refunds are only issued if the same book is not available for replacement.

Books that are in good condition, opened, or returned for personal reasons are not eligible for exchange or refund.

For any assistance or to file an exchange request, please contact us at readifyy01@gmail.com.

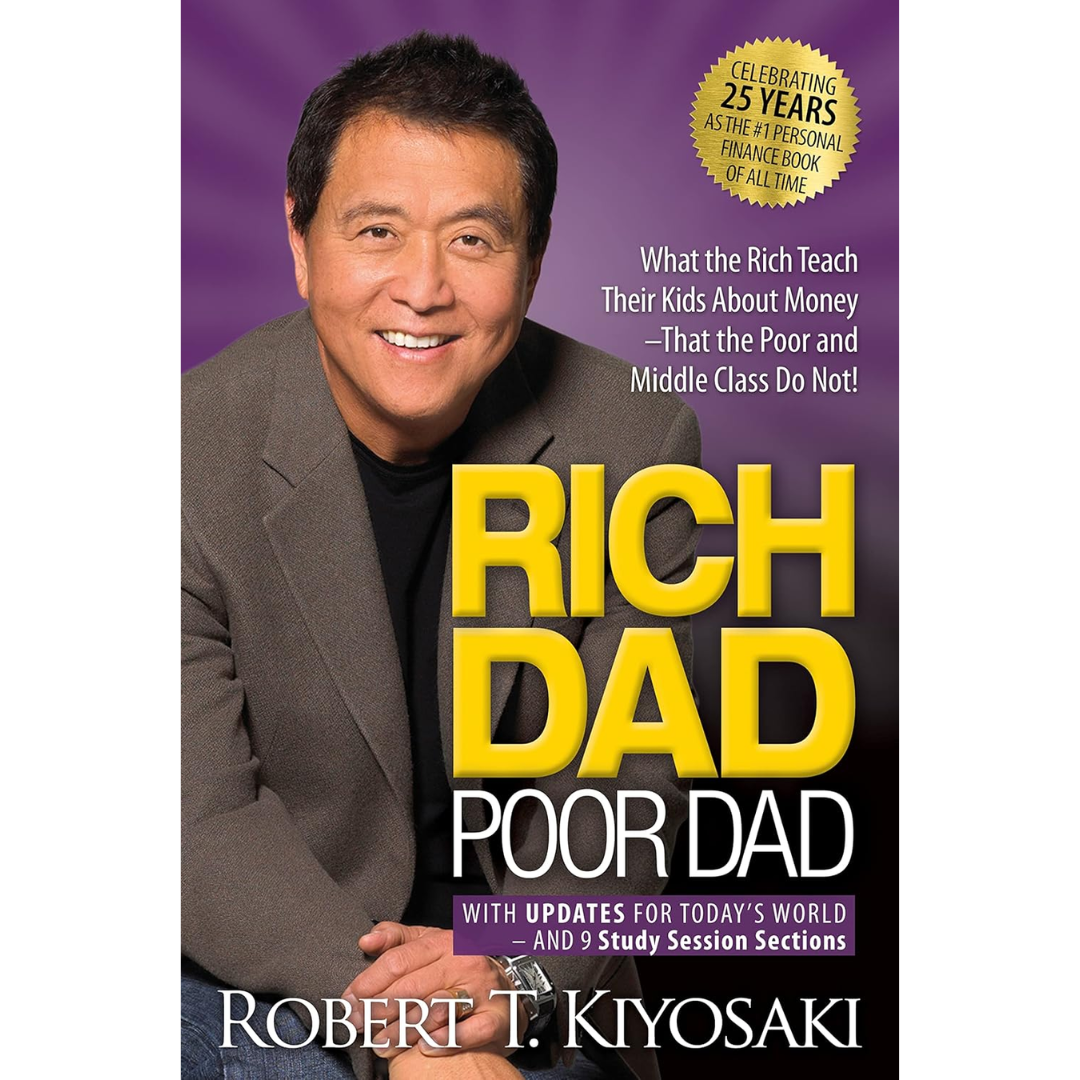

While you may console yourself with the fact that for your friend, it was a sheer ‘stroke of luck’, the truth behind his success and your current status is much more profound – the truth is though your friend is being the ‘rich dad’, you may not be making adequate efforts to move out of the ‘poor dad’ zone.

Here are five reasons why it is taking you so long to be the ‘rich dad’ and why many like you are unable to break out of the ‘middle-class’.

1. Create multiple sources of income

Millionaires, on an average, have at least seven sources of income. While extracting more juice out of a single source may not be an easy task, the easier way to get more juice is by increasing the number of sources. Sources of income other than your regular salary can include income from mutual funds, freelancing and similar.

2. Make your money work for you

While the middle-class always strive and work extremely hard to ‘earn’ money, the rich make every penny work for them. While the middle-class slog for typically nine hours a day, five days a week to earn a nominal salary only to later squander it over ‘liabilities’. At the same time, the rich ensure that every penny that they hold is invested well enough to fetch returns for their fortune – investments are not just limited to financial products; investing an amount to upgrade knowledge is also a prudent investment.

3. Failures inspire winners and defeat losers

Every failure should be taken up as an opportunity to introspect and learn from the experience. Mistakes and failure do not make you a loser but failing to learn from the experience is a sure way to lose.

4. Risk is to be managed, not avoided

At the cost of sounding cliché, risk and returns move in the same direction. Risk is different from uncertainty – risk can be managed and calculated to certain degree. Risk emanates from one’s lack of knowledge and awareness and not because of the system per se. As Kiyosaki puts it – “I have never met a rich person who has never lost money. But I have met a lot of poor people who have never lost a dime…investing, that is.”

5. Stop buying liabilities assuming them to be assets

It is important to understand what an asset is, and then buy more of it. Although many feel that it is simple to identify an asset from a liability, many tend to repeat the same mistake – buying liabilities, assuming them to be assets.

An asset is something that can yield economic benefits for the owner in future while a liability is something that needs consistent expenses.

A car, for example, may seem to be an asset but in reality, it is a liability – you need to pay for maintenance, insurance and other ad-hoc expenses while the value of the car is continuously depreciating.

Pride says, “impossible”

Reason says, “pointless”

Experience says, “impractical”

Doers ask, “When do we start?”

You will never be as young as you are today; the best day is today, and best time is now.

If you continue being the average middle-class guy, it is only because you chose to be that guy.

Thanks for subscribing!

This email has been registered!

Take 20% off your first order

Enter the code below at checkout to get 20% off your first order